Cash Equivalents Will Be Converted to Cash Within

Are a comparisom of cash and liabillities. Will be converted to cash within 90 days.

Cash Equivalents Definition Examples Complete Guide

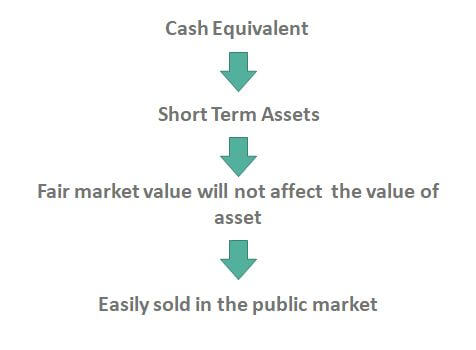

Are expected to be converted to cash within three months.

. Question 9Cash equivalents includeamoney market accounts and commercial paperbchecksccoins and currencydstocks and short-term bondsQuestion 4A check drawn by a company for 340 in payment of a liability was recorded in the journal as 430. Dwill be converted to cash within. Cash equivalents awill be converted to cash within four months bwill be converted to cash within three months cwill be converted to cash within two years dare illegal in some states.

Will be converted to cash within one year. Lenders like to see large percentages of assets held in cash and cash equivalents rather than tied up in real estate or stock in small. Short term highly liquid investments that can be readily converted to cash with little risk of loss.

Accounting questions and answers. Cash equivalents awill be converted to cash within 120 days bwill be converted to cash within two years care illegal in some states dwill be converted to cash within 90 days. 5A check drawn by a company for 270 in payment of a liability was recorded in the journal as 720.

Will be converted to cash within two years2. Are illegal in some states3. Will be converted to cash within three months Step-by-step explanation Cash equivalents can be defined as the total value of cash on hand which comprises items that are similar to cash.

The type of account and normal balance of Petty Cash is an aexpense debit bliability credit. Which of the following is true about a. Will be converted to cash within 120 days 4.

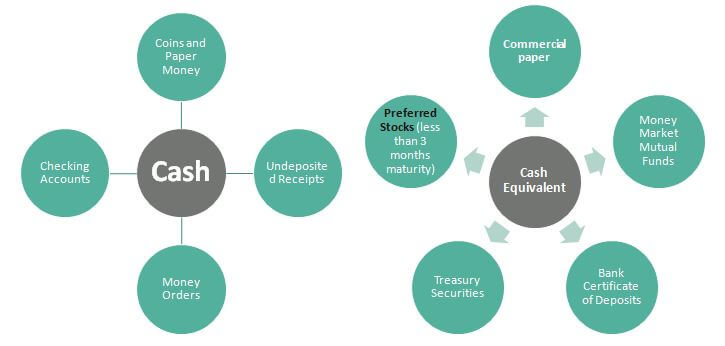

CCE is actually two different groups of very similar assets that are commonly combined because. Cash equivalents are investments that can be readily converted to cash. An asset that is owned by a company and that can readily be converted to cash.

A cash equivalent can be defined as a liquid investment that can be converted into cash _____. Will be converted to cash within 120 days4. Cash equivalents will be converted to cash within 90 days 1Which of the from ACCOUNTING 101 at Argosy University Phoenix.

For an investment to qualify as a cash equivalent it must be readily convertible to a known amount of cash and be. Cash equivalents will be converted to cash within 90 days Thompson Company gathered the following reconciling information in preparing its October bank reconciliation. The term cash equivalent refers to _____.

Cash and cash equivalents should be current assets. Cash and cash equivalents must be current assets. Will be converted to cash within two years 2.

Cash equivalents by definition. - a company asset that is short-term and highly liquid - a money market account. Will be converted to cash within 90 daysSave Answer2Points.

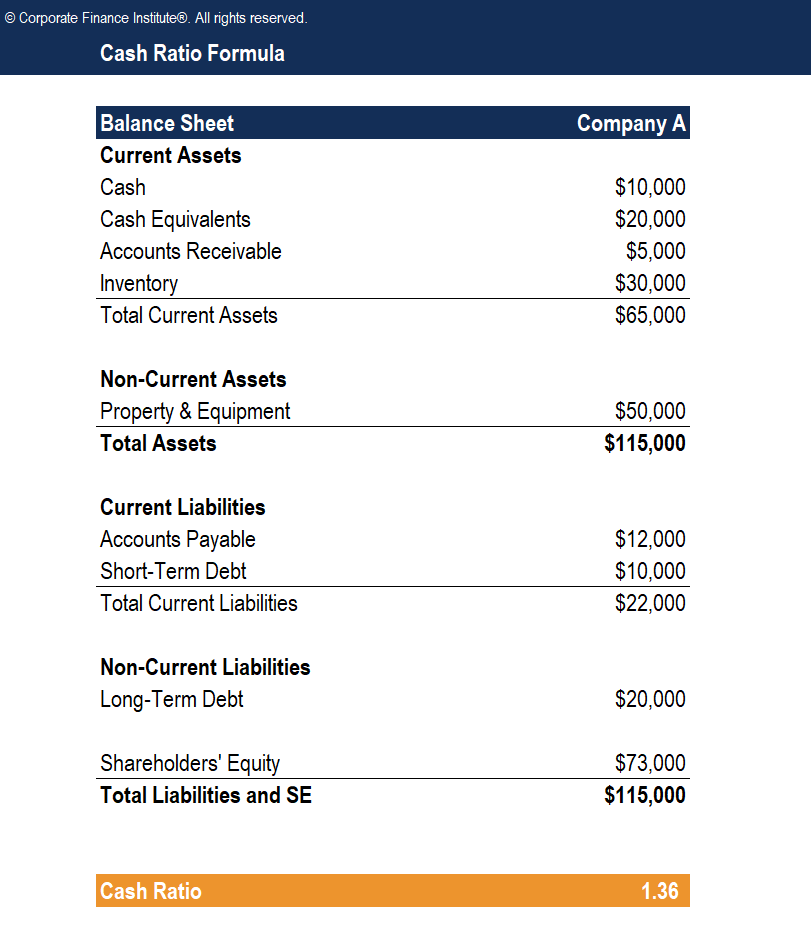

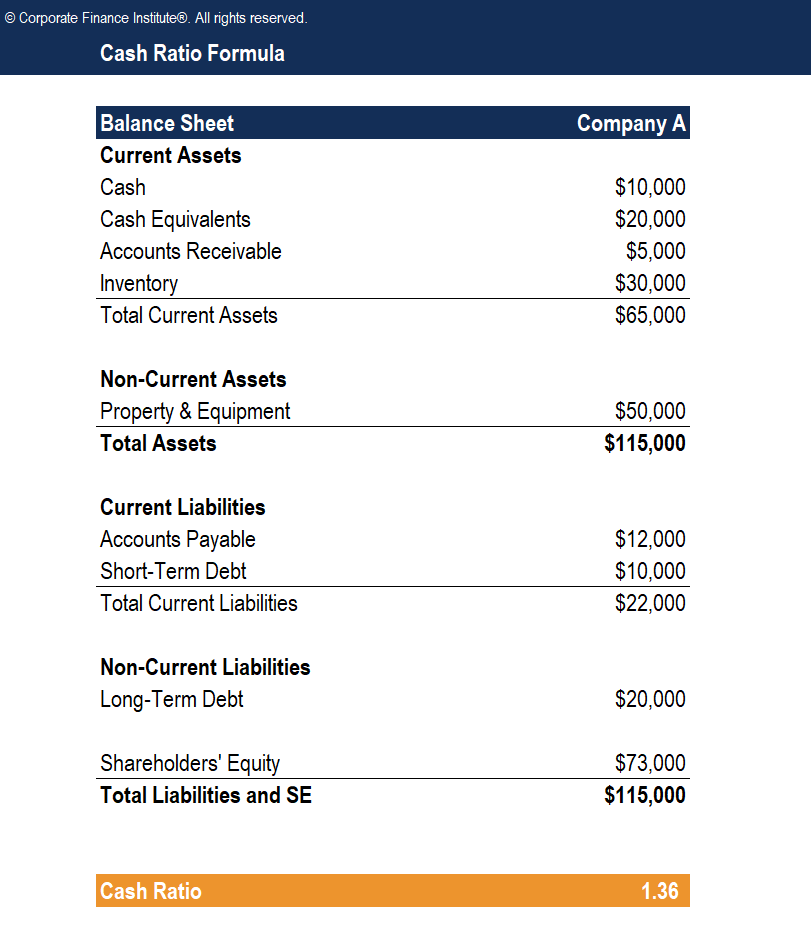

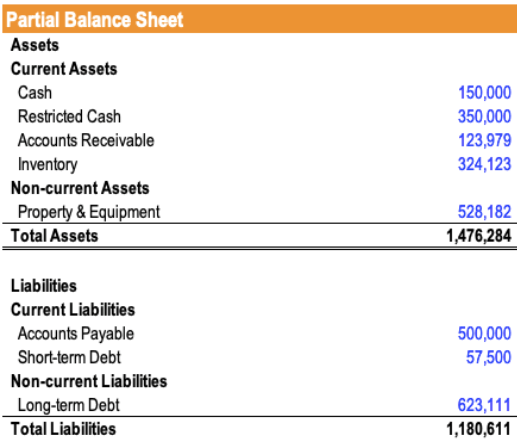

Are a comparison of cash and liabilities. Net working capital is equal to current assets less current liabilities Current Liabilities Current liabilities are financial obligations of a business entity that are due and payable within a year. No distinction between cash in the form of currency or bank account balances and amounts held in cash-equivalent investments.

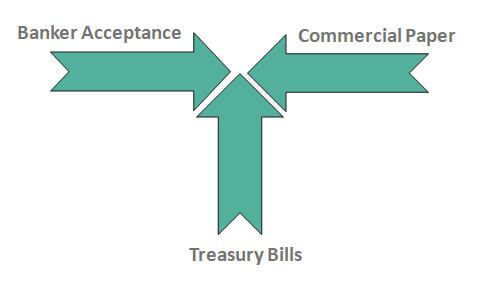

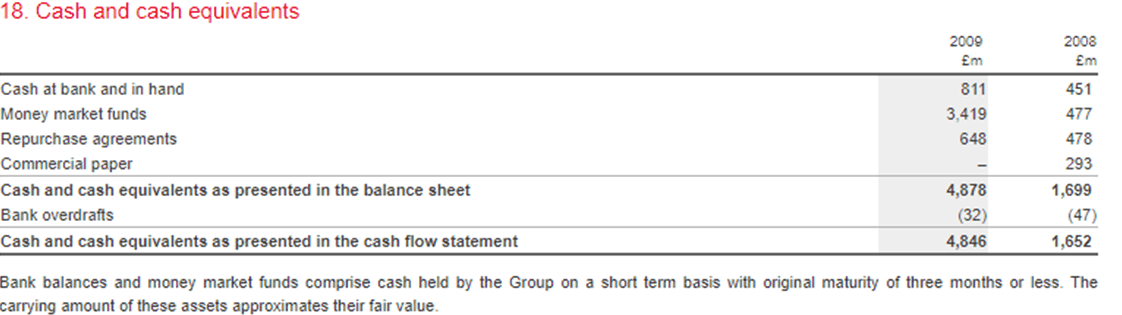

Common examples of cash equivalents include commercial paper treasury bills short term government bonds marketable securities and money market holdings. Cash equivalents a will be converted to cash within two years b will be from ACCO 20163 at Polytechnic University of the Philippines. Cash equivalents are the total value of cash on hand that includes items that are similar to cash.

Will be converted to cash within one. Cash equivalents are short -term investments that will be converted to cash within 120 days. - in 12 months or less.

Dwill be converted to cash within one year. Will be converted to cash within 90 days. 5 A check drawn by a company for 270 in payment of a liability was recorded in the journal as 720.

A cash equivalent can be defined as a liquid investment that can be converted into cash _____. Cash equivalents by definition a. Cash equivalents by definition a.

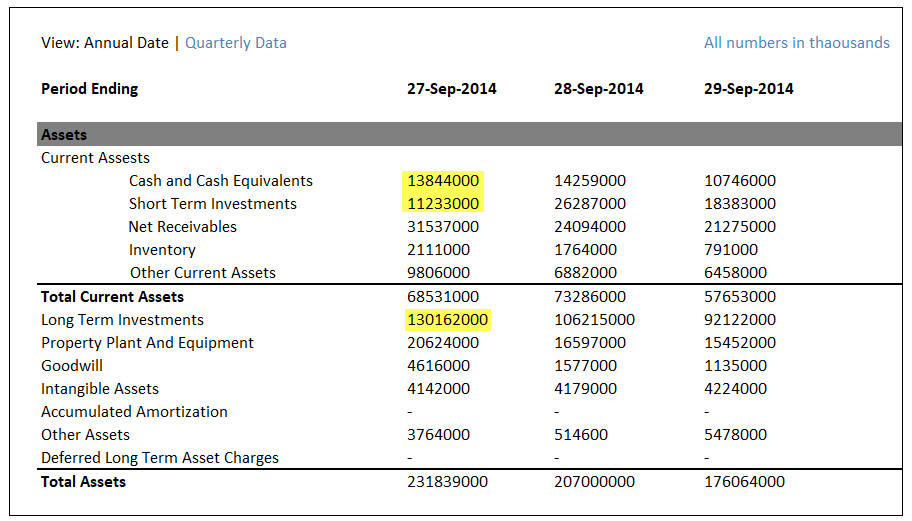

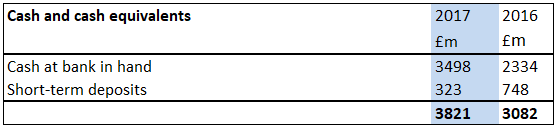

Cash and cash equivalents are part of the current assets section of the balance sheet and contribute to a companys net working capital. Cash equivalents are illegal in some states will be converted to cash within two years will be converted to cash within 120 days will be converted to cash within 90 days. Are illegal in some states 3.

A companys combined cash or cash equivalents. See the answer See the answer done loading. An item should satisfy the following criteria to qualify for cash equivalent.

Are a comparison of cash and liabilities. The term cash equivalent refers to _____. Cash equivalents O will be converted to cash within four months O are illegal in some states O will be converted to cash within two years O will be converted to cash within three months.

Are expected to be converted to cash within three months.

Cash Ratio Overview Example Free Template Download

Cash And Cash Equivalents U S Gaap Accounting Definition

Liquid Assets Learn Accounting Accounting Education Bookkeeping Business

Cash Equivalents Definition Examples Complete Guide

Restricted Cash Overview Reasons For Restriction Example

Note 1 Cash And Cash Equivalents Annual Reporting

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

Current Assets Definition Examples Accounting Treatment

Cash Equivalents Uses And Examples Of Cash Equivalents

Cash Equivalents Definition Examples Complete Guide

Cash Equivalents Definition Examples Complete Guide

Cash Equivalents Definition Examples Complete Guide

Cash Equivalents Definition Examples Complete Guide

Cash And Cash Equivalents Example Of Cash And Cash Equivalents

/dotdash_Final_Other_Current_Assets_OCA_Dec_2020-01-1ef8bd75eff345e7ac48ba70fb718619.jpg)

Comments

Post a Comment